Course 1 - Precision Trading Cycle Tops and Bottoms

- What Moves the Market

- The 3 Energies

- Multi-Chart Confirmation

- Money Management

Course 2 - Momentum and Catching the Big Moves

This course takes you to a new level in trading skills, once you see how this works you will never trade again without it.

Course 1 - Precision Trading Cycle Tops and Bottoms

We’ll learn in this course WHAT MOVES THE MARKETS?

Making money in the markets using technical analysis is deceptively difficult. We are attempting to find clues that will indicate where the market is going in the future so we can get in now and ride it to the expected destination in the future.

To develop a strategy that will help us determine where the market will be in the future, we need to first ask: “What moves the markets?”

The answer is simple: People move the market — LOTS of people!

The irony is that even though the masses move the market, approximately 5% of the people make 95% of the money! So market moves are the basis of mass psychology, but the masses lose and the minority wins. In this course, we will learn how to be among the 5% who profit from the market. I will teach you trading methods and strategies that work! I will teach you how to be on the right side of the market!

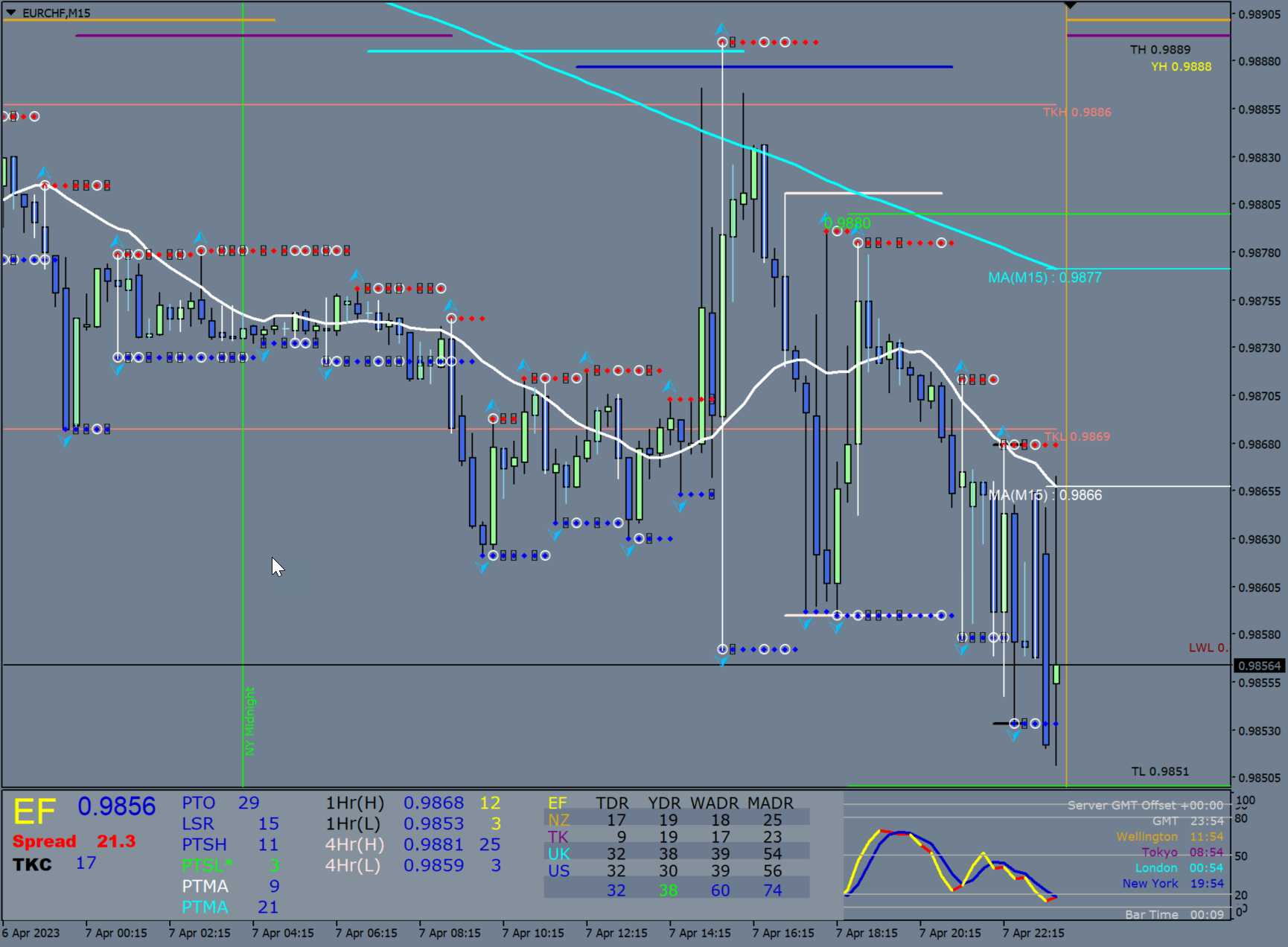

The 3 Energies that we’ll learn in this course:

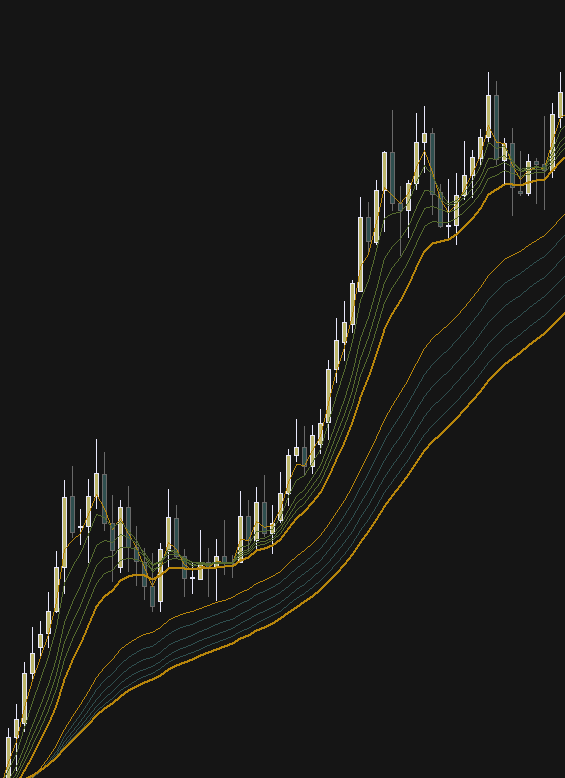

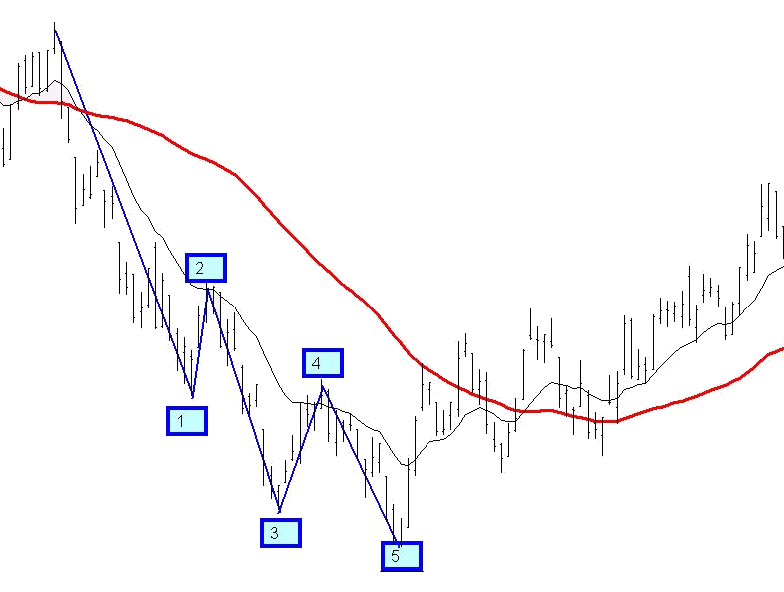

1. TREND (primary direction or destination)

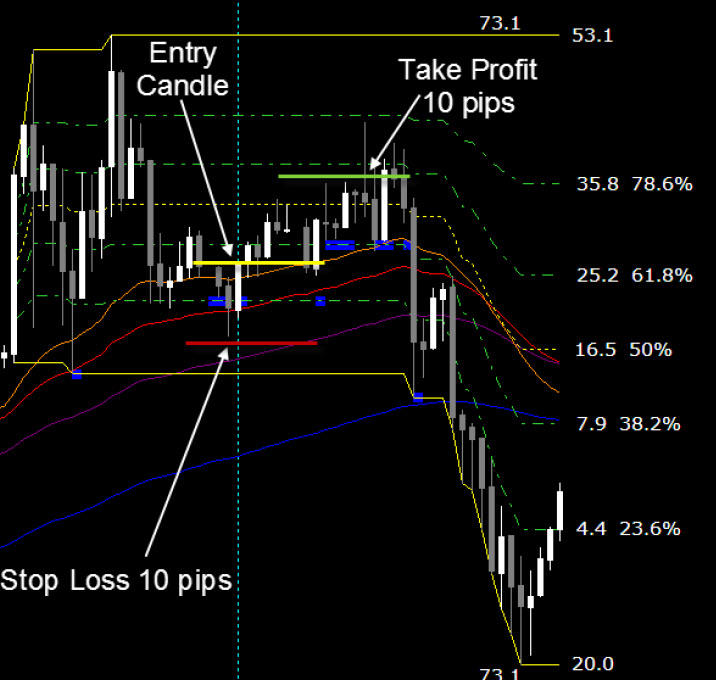

2. CYCLES (temporary turning points)

3. SUPPORT/RESISTANCE (traffic lights)

Multi-chart Confirmation that we’ll learn in this course:

These navigation tools will help us create a meaningful map for high-probability trading. Not only that, but we will use several different time frames. This is consistent with our map analogy. You need a “big picture map” to plan your entire trip (the freeways or expressways) but you need a smaller map that includes the details of every side street to plan how to get to the freeway and how to get off and navigate to the exact address of your destination.

Never trade one chart by itself. The odds of success are not worth risking your precious capital.

The probabilities of success are greatly enhanced when you use multiple charts that align to confirm the same trade.

Money Management that we’ll learn in this course:

Disciplined money management is not optional for successful trading. If you don’t employ stellar discipline in managing your money, it’s only a matter of time before you lose your money.

Our money management rules are simple. It is up to you to stick to them religiously.

First, you should not be trading more contracts than your account size would dictate. Your broker’s margin rules may not be the best guide as some brokers are very liberal in this area.

Trading one contract is much more difficult than trading with the flexibility that multiple contracts give you. Multiple contract trading allows you to take some profits quickly and therefore quickly reduce your risk in the trade. This also allows you to increase your win/loss ratio which is psychologically critical and will in turn reinforce your ability to stick to your rules.

Course 2 - Momentum and Catching the Big Moves

In this course, we focus on a new energy – MOMENTUM.

To engage in momentum trading, you must have the mental focus to remain

steadfast when things are going your way and to wait when targets are yet to

be reached.

Watch the video which is the first video of the course and you will see how deeply you can really understand the market and what is really happening on the chart. And this is just the first of many videos.

Trade My Wave

Trade My Wave